wyoming tax rate for corporations

See the publications section for more information. As discussed previously the 2018 tax obligation reform expense was a big win for C corporations.

Corporate Tax In The United States Wikiwand

The federal corporate tax together with the combined state tax rate in Wyoming is 210.

. Free Unlimited Searches Try Now. However four of those states Nevada Ohio Texas. The sales tax is about 542 which is fairly low.

Wyoming has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. There is no tax to the LLC on LLC income. Sales Tax Rates Updated January 2022.

Learn about Wyoming tax rates rankings and more. The tax is either 60 minimum or 0002 per dollar of business assets whichever is greater. In this scenario the Wyoming LLC holding company must have filed an election with the IRS to be treated as a C Corporation.

Personal Service Corporations may be taxed at a different rate. Have the holding company be taxed like a C corporation. A C corporation keeps its profits at the company level.

Some states have other taxes based upon the value of deposits or shares. LLCs under a C-Corporation election that accumulate and do not distribute after tax profits are subject to an accumulated earnings tax. 9975 b Flat Rate 1.

In its intended form moreover its highly nonneutral targeting certain businesses but not others. 9975 b Puerto Rico a Rates listed include the corporate tax rate applied to financial institutions or excise taxes based on income. Corporate Income Tax Rates by State.

North Carolina has a corporate tax rate of 30. Some of the advantages to Wyomings tax laws include. The annual report fee is based on assets located in Wyoming.

B Minimum tax is 50 in Arizona 50 in North. Wyoming C Corp Tax Rate. Tax Bracket gross taxable income Tax Rate 0.

No corporate income tax. 10 -Wyoming Corporate Income Tax Brackets. Wyoming corporations still however have to pay the federal corporate income tax.

The state of Wyoming does not levy a personal or corporate income tax. Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax. 12 memo from the Wyoming Department of Revenue the bill.

Wyomings proposed corporate income tax only falls on a few select industry sectors at least initially but its a foot in the door for a broader corporate taxsomething Wyoming has consistently resisted over the years. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your earnings. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

There is no tax except in two limited circumstances. States With Corporate Taxes under 6. All profits or losses pass through and are taxed to the members.

1 Recognized built-in gains and 2. Wyoming Secretary of State Business Division Herschler Building East Suite 101 122 W 25th Street Cheyenne WY 82002- 0020 Ph. Low property tax percentages.

On top of that rate counties in Wyoming collect local sales taxes of up to 2. Explore data on Wyomings income tax sales tax gas tax property tax and business taxes. Wyomings property tax rate is 115 for industrial property and 95 for commercial.

The Excise Division is comprised of two functional sections. The table below shows the total state and county sales tax rates for every county in Wyoming. This is typically at a rate of 153 percent.

State wide sales tax is 4. The new corporate tax rate of 21 percent can imply considerable tax obligation savings for all C corporations especially if a business does not on a regular basis make distributions to proprietors in the form of returns. Even with added taxes within different counties or municipalities the tax rate is normally no higher than 6 percent.

No entity tax for corporations. No personal income taxes. Download tax rate tables by state or find rates for individual addresses.

A C Corporation will pay the IRS C Corporation otherwise known as corporate income tax tax rates. Wyoming Department Of Revenue Wyoming Tax Wyoming Business Corporate Tax Wyoming Personal Income Tax Wyoming Sales Tax Rates What is the Wyoming corporate net income tax rate. A Wyoming LLC also has to file an annual report with the secretary of state.

One tax rate of 21 applies to taxable income. Wyoming Use Tax and You. Ad Lookup State Sales Tax Rates By Zip.

While not 0 the corporate tax rate in these states is still relatively low. An LLC may accumulate earnings of up to 250000 without incurring this tax. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

Personal rates which generally vary depending on the amount of income can range from 0 for small amounts of taxable income to around 9 or more in some states. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax. Currently six states Nevada Ohio South Dakota Texas Washington and Wyoming do not have a corporate income tax.

Other Wyoming tax facts. 4 percent state sales tax one of the lowest in the United States. Though its not likely to raise much money just 231 million per year at a tax rate of 7 percent according to an updated Sept.

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

The Dual Tax Burden Of S Corporations Tax Foundation

Corporate Taxes By State In 2022 Balancing Everything

Corporate Income Tax Definition Taxedu Tax Foundation

The Gaming And Decline Of Oregon Corporate Taxes Oregon Center For Public Policy

Corporate Tax Rates By State Where To Start A Business

Corporate Tax Rates By State Where To Start A Business

Corporate Income Tax Definition Taxedu Tax Foundation

Corporate Tax In The United States Wikiwand

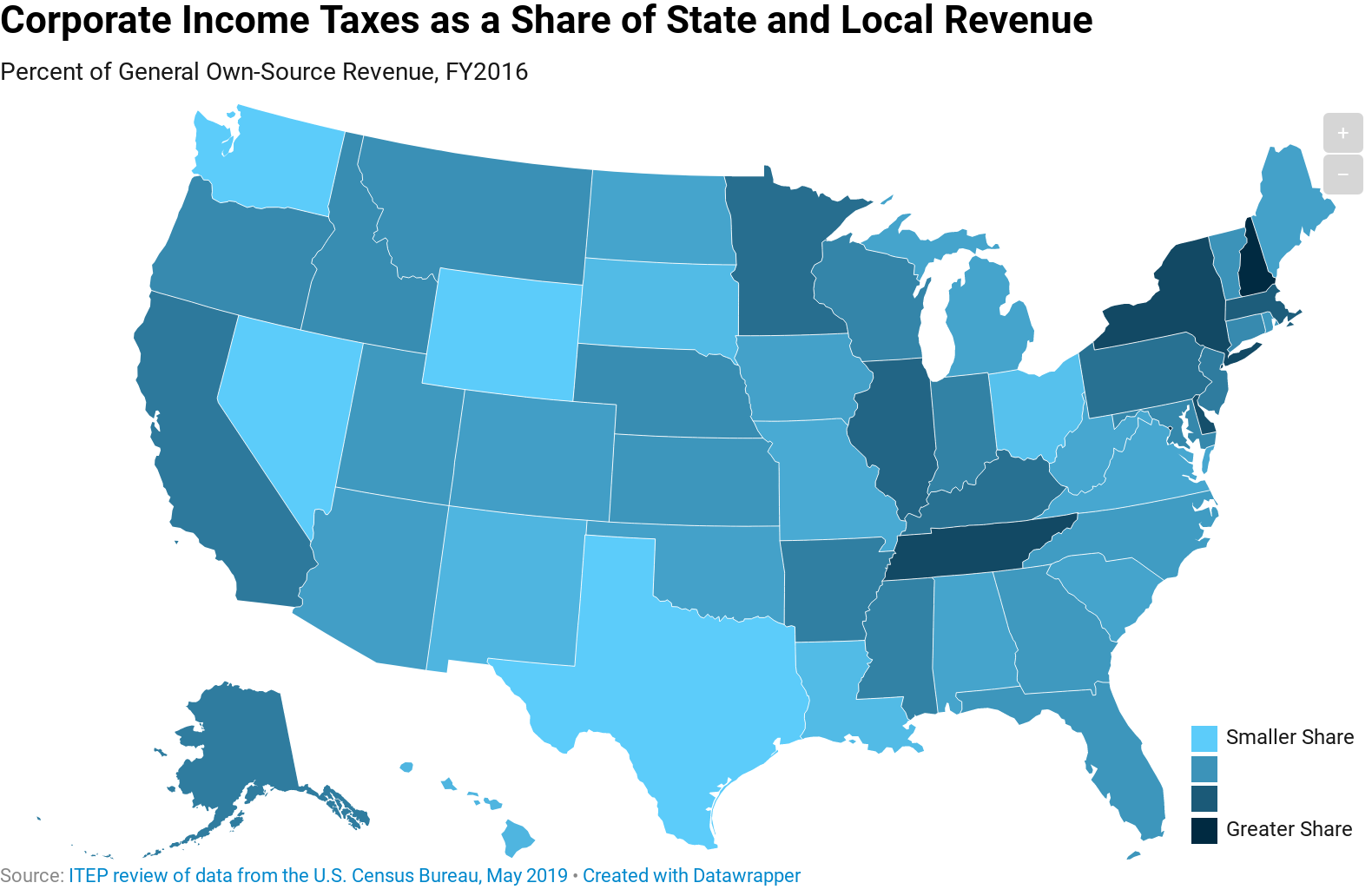

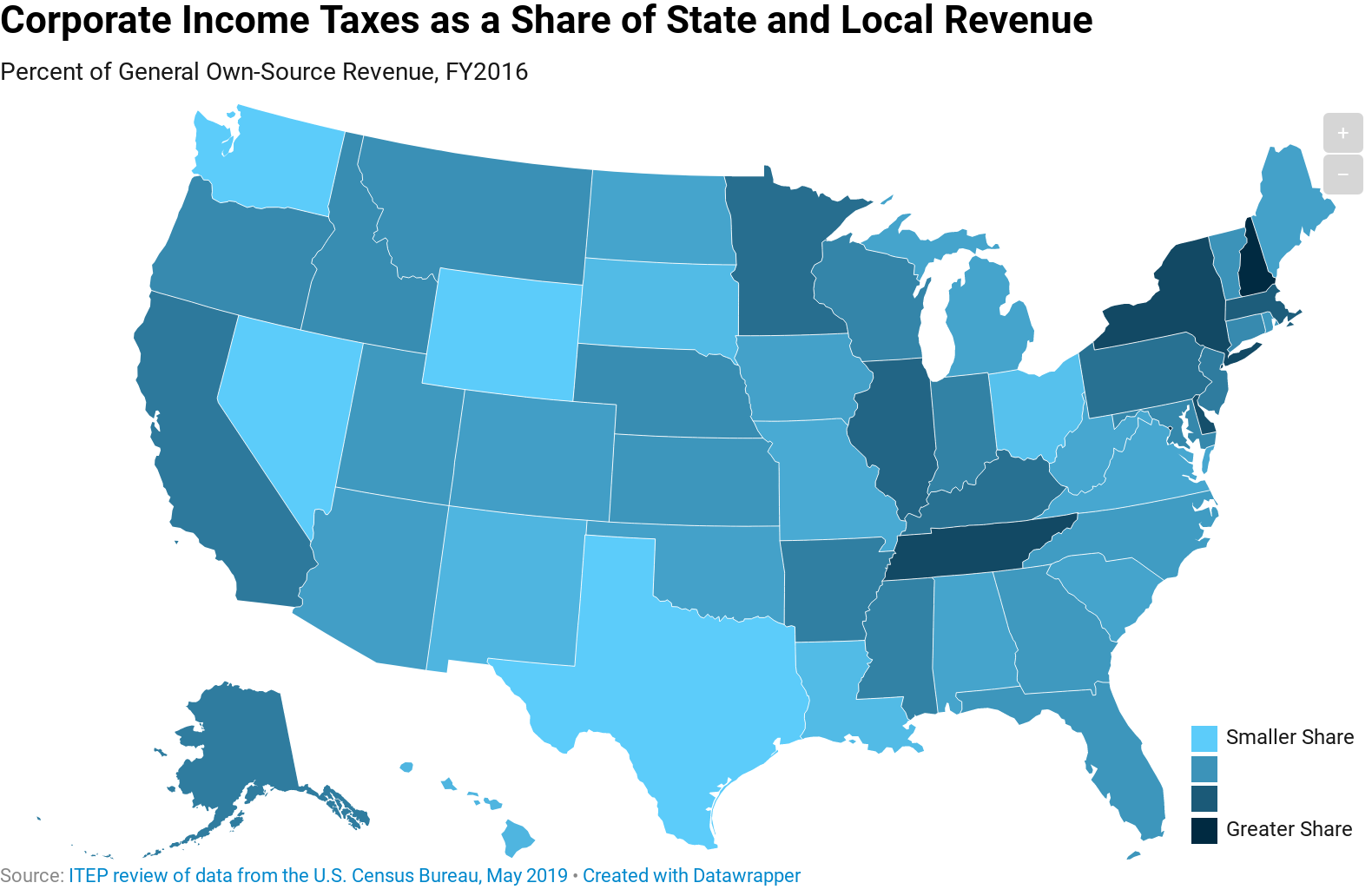

How Heavily Does Your State Rely On Corporate Income Taxes Itep

A Territorial Corporate Tax Would Reward Corporate Tax Avoidance And Could Encourage Offshoring Center For American Progress

Corporate Income Tax Definition Taxedu Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Senate Tax Bill Makes It More Expensive To Go To Work The Senate Bill Lowers The Highest Individual Tax Rate Expands T Estate Tax Tax Credits Work Family

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How Do State And Local Corporate Income Taxes Work Tax Policy Center

State Corporate Taxes Improve The Tax Burden On Corporate Earnings Tax News Daily

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy